See Your Cash Flow…See Your Cash Grow: How Cash Flow Builds Long-Term Success

As a business owner, understanding cash flow is critical to the success of your operation. So, what exactly is cash flow? Here’s a brief description of what it is…and what it’s not.

We What is cash flow?

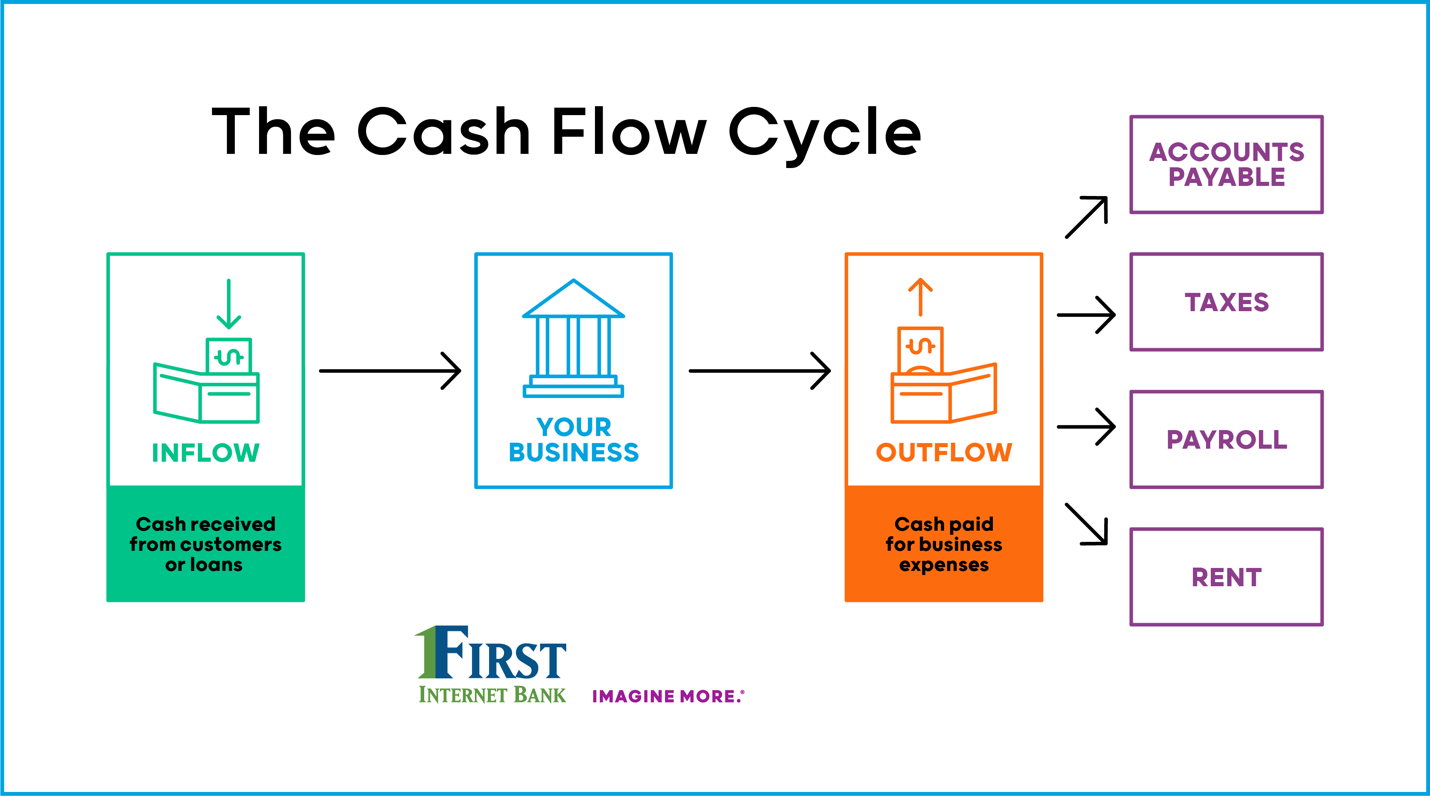

Simply put, cash flow is the amount of money coming into and going out of a business measured and recorded over specific time periods, ranging from daily reviews to an annual summary. All company income, overhead and expenditures, such as money made from sales, regular expenses like rent, invoices, payroll and taxes are taken into account in financial reporting, along with payments on business loans or investments in growth. Learn more about our Cash Flow Analysis tool.

The objective of the financial report is to be able to assess:

- The amounts and timing of cash

- Where the funds came from and where they go

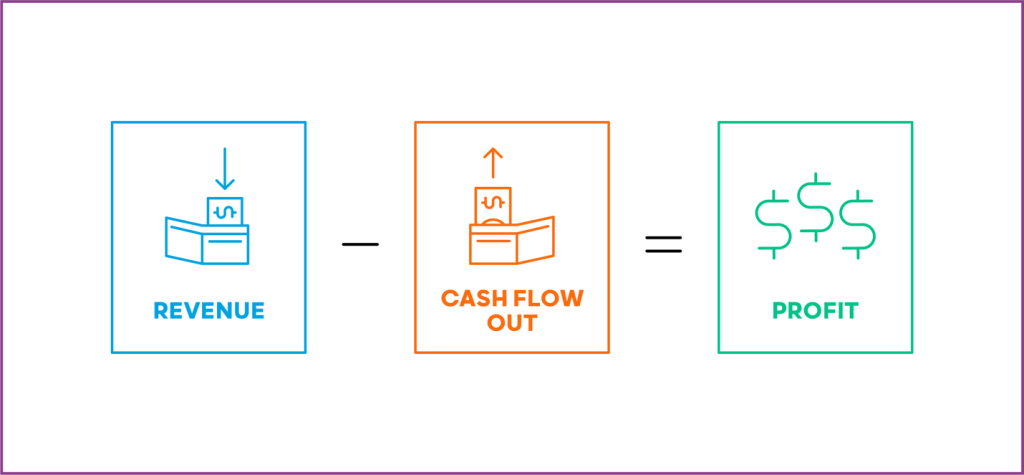

What it’s not: cash flow and profit are different:

Now that we’ve defined what cash flow is, it’s also important to note how it differs from profit:

- Again, cash flow is the money that goes in and out of a business

- Profit measures financial success, or how much revenue the business makes after all expenses are subtracted

In other words, while profit is the goal of every company, cash flow is what keeps it operating. Profit is a measurement of ongoing sustainability, while cash flow indicates the ability of a business to pay its bills.

Good cash flow management is vital:

An important note to business owners: never underestimate the value of effective cash flow oversight. Successfully managing the flow of incoming and outgoing funds, ensures that there is enough cash to meet all current financial obligations and make investments to improve future business.

Cash flow management tracks and coordinates past, present and future expenses. It ensures that not only are invoices paid on time, but that employees are adequately paid and that future funds are available. When cash flow is effectively managed, the risk of business failure is reduced, and growth is a greater possibility.

One of the key management tools is the cash flow statement. It provides a detailed breakdown of a business’ cash inflows and outflows over a particular period. Monitoring cash flow statements allows business principals to identify valuable patterns to help adjust both budgets and future plans.

What is cash flow forecasting?

Think of it in much the same way that weather forecasts predict sunny or rainy days. Cash flow forecasts look to the future and estimate a business’ cash in- and outflows. This can help drive decisions to increase budgets or cut costs by projecting cash flow over a specific time period: monthly, quarterly or annually.

As a practical matter, some lenders require forecasts from potential borrowers that look out as far as two years into the future. Knowing what might be ahead can help businesses plan accordingly.

For example, companies with a positive forecast might look to make investments, expand their business or pay employees more. Cash-negative companies will need to maintain close tabs on their cash flow in order to keep paying suppliers, employees, taxes and lenders on time.

Effective management of your cash flow is crucial to success. And now you can make the entire process simpler. Do More BusinessTM Checking accounts from First Internet Bank offer Cash Flow Analysis – financial tools that allow you to:

- Access key cash flow metrics 24/7

- Receive insights based on your current data

- Benchmark your performance against industry peers

- Effectively forecast revenue streams based on the impact of your financial decisions

Plus, Do More Business Checking delivers even more:

- Zelle® for your business, the fast and easy way to send and receive payments.

- Balance Optimizer to build your profits with maximum interest

- No minimum balance or maintenance fees

- Unlimited transactions

- See all your personal and business accounts – from all institutions – at a glance

- Track your net worth and financial wellness.

In 1999, First Internet Bank founder David Becker had a radical notion – to

create a bank that lived entirely online. From our inception, we’ve been driven by an entrepreneurial spirit. Did we start a banking revolution? That’s an understatement!

From anytime, anywhere “Do More” business banking that includes checking and savings accounts to personal banking products and so much more, we continually seek innovation to best serve our customers nationwide.

Check out our FDIC-insured Do More BusinessTM Checking (now with Zelle® for your business) account and all the advantages it delivers. It’s like having your own digital CFO…apply online in minutes today!

Hey, We Know Somebody!

One other step remains before you can earn that first dollar to frame on the wall. A business checking account lets you handle legal, tax and day-to-day issues. The good news is it’s easy to set one up if you have the right registrations and paperwork ready. If you’ve secured your commercial loan, or one through the Small Business Administration, you probably already have a particular bank in mind.

There’s a lot to consider when you make that choice: interest rates for checking and saving accounts, transaction and account balance fees, plus a lot more. But the right bank (hint, hint) will provide not only the best overall balance between rates and service, but also be the type of partner you’ll need to help your business thrive. Oh, yeah…one more thing: along with your banker, don’t forget to find an insurance agent who can provide the coverage and expertise you’ll need as your business takes off.

Now you’re ready to put that big idea to work and take on the world! Good luck! And remember, when you are ready to get your business banking in order, it’s important to choose the best…and there’s no better place to start than with the FDIC-insured, award-winning Small Business Checking account from First Internet Bank (yeah, that’s the “hint” from a couple paragraphs back). When you look at the features we offer, it’s easy to see why we’re a winner!

Open a small business checking account

Dollar amount restrictions may apply.

Terms and conditions apply. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.