Platform banking:

- What it is: banks integrating services from other providers, primarily fintechs, in order to offer the bank’s customers a broader (or more specialized) range of financial services.

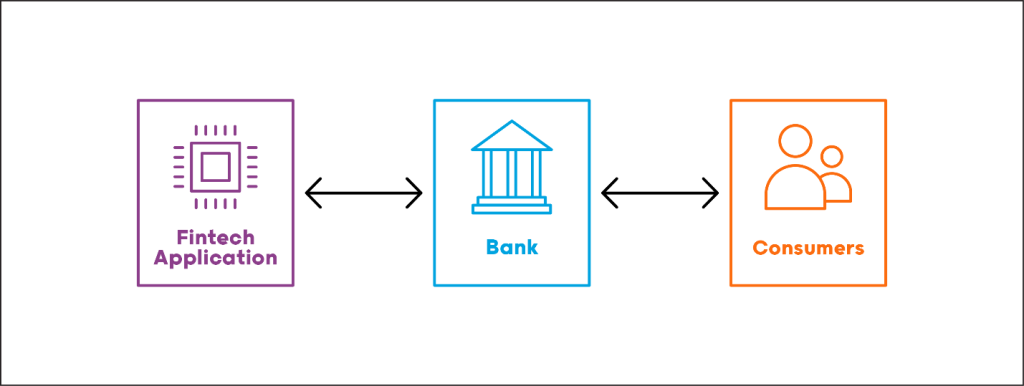

- How it works: depending on the type of set-up, the fintech’s services are usually fully integrated into the bank’s app/webpage via application programming interface (API), a connection between computers or computer programs.

Platform banking refers to banks using fintech services to complement their existing product offerings. In a broad sense, platform banking can be described as the opposite of Banking as a Service (BaaS).

In the BaaS model, the primary customer relationship is maintained by the fintech/non-bank, while integrating a variety of products or services from the bank. For non-banks, this is valuable as it allows them, for example, to offer affinity debit or checking cards that can build customer loyalty.

Conversely, in the Banking as a Platform (BaaP) banking model, the bank has the customer relationship and integrates services from fintechs. By merging the fintechs’ services into their platform, banks can sustain and expand their customer base with a broader range of services, while fintechs benefit from an increased revenue stream. In potential, everyone wins:

- Consumers win because they receive new and better services from a bank.

- Fintechs, because they can profitably sell their product to an established financial institution

- Banks, because they have an opportunity to increase customer satisfaction, while saving money on development and support.

Innovation in any industry is hard, but even more so for banks. For traditional institutions, overhead from their brick-and-mortar retail footprint makes it hard to cut costs, while the widespread structure they have maintained for years increases the difficulty in planning and rolling out new products quickly, particularly in providing the training for employees spread across the organization.

That’s where Banking as a Platform comes in. Major BaaP benefits include:

- Reduced development time and cost of innovation for banks

- Maintenance costs are usually the responsibility of the developing company

- Timing of release for new products/services can be controlled

- Increased customer satisfaction.

Best of all, platform banking can deliver highly scalable solutions. In markets with a large number of competitors, differentiation is critical. By choosing specific BaaP products, banks can build their product lineup around their particular strengths or perceived advantages. In less competitive ones, they can adopt the opposite strategy by offering every possible service they can to serve their customers.

Whichever path a bank takes, virtually any fintech product or service can be adapted and introduced into a bank’s platform. Here are just a few of the available financial tools:

- The ability to make payments by phone

- AI-backed automated investing platforms

- Personal finance management tools

- Online customer onboarding

- Marketplace for insurance and other financial services

By partnering with Banking as a Platform providers, banks and other financial institutions can remain focused on their core business. At the same time, they also can continue to deliver new products and services as they become available to their personal and business customers, enhancing the value of each account.