DO MORE BUSINESS™ CHECKING

When you run a business, you have a lot on your mind. Here’s a no-brainer – our award-winning+ Do More BusinessTM Checking. Enjoy cash flow tools, unlimited transactions and the ability to earn interest* on your account balance. Plus, track all your finances in one place to see the big financial picture. Doing more in less time? That should be a no-brainer, too!

+As recognized by Best in Biz Awards 2024

Enjoy benefits designed for your business:

No minimum balance, maintenance fee or overdraft fees

Hidden fees? No, none of those here!

Unlimited transactions

Because you shouldn’t have to pay to run your own business

Competitive interest*

Earn 0.50% APY with an average daily balance of $10,000

Dedicated customer success specialists

Need help? Our team has you covered

Cash Flow Analysis

Unlock cash flow forecasting, competitive benchmarking and more

Balance Optimizer

Maximize earnings by moving excess deposits to higher-yield Business Savings accounts

BUT THAT’S NOT ALL

Introducing Zelle® for your business. It’s the fast and easy way to send and receive payments.

Terms and conditions apply. The Zelle® related marks are used under license from Early Warning Services, L.L.C.

Zelle® for your business is available for eligible Do More™ Business Checking, Business Money Market and Business Savings customers.

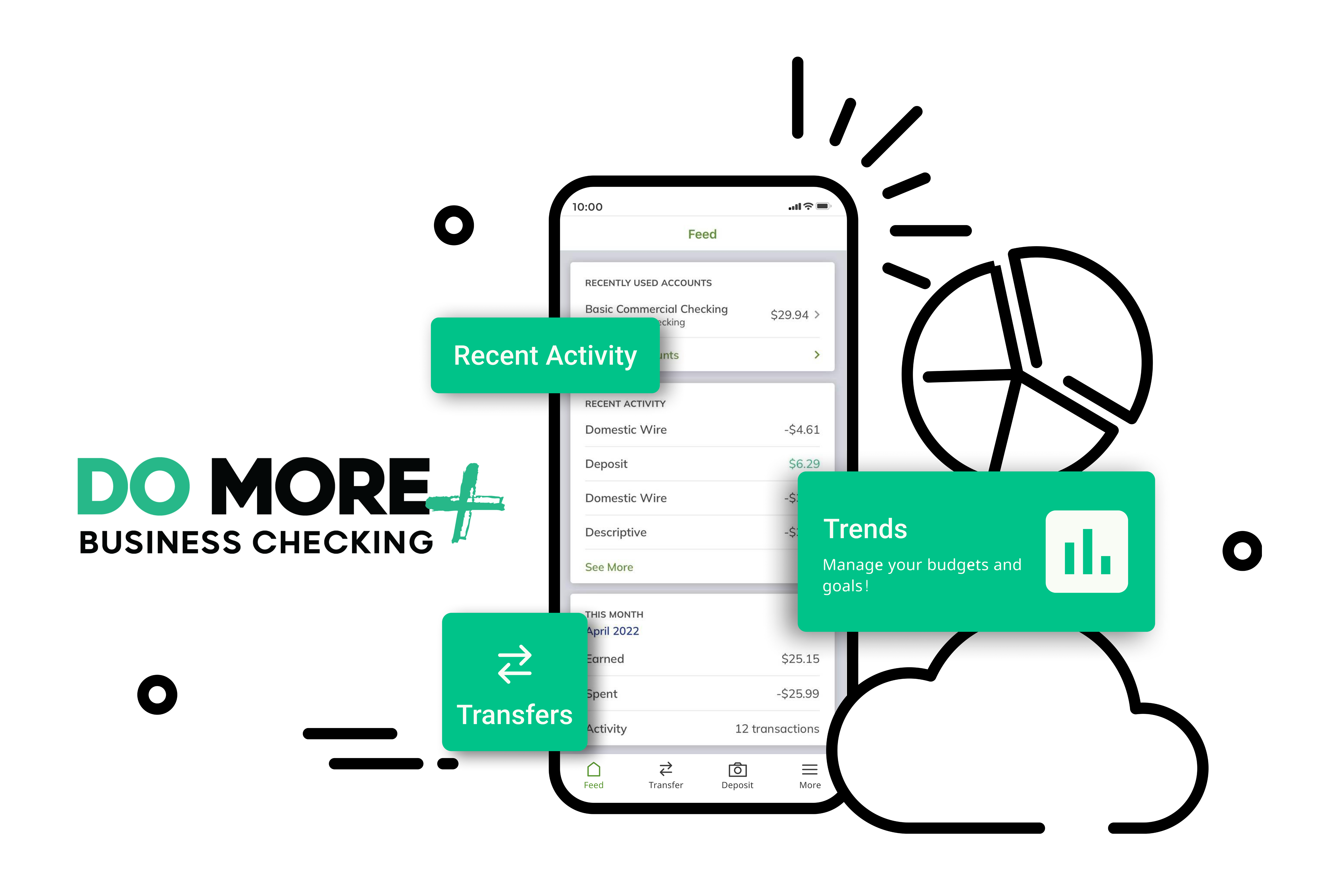

See your big financial picture – even on a small screen

Get the whole picture on desktop, mobile or tablet devices. Do More BusinessTM Checking gives you greater control of both your business and personal finances:

- See all of your personal and business accounts at a glance. That means all of them – even those at other financial institutions. Plus, you can add additional accounts like credit cards, mortgages and investments

- Gain insight into your future financial goals with budgeting tools

- Track your net worth and financial wellness

First Internet Bank was founded by an entrepreneur, so we understand that the needs of small businesses constantly change. Stay ahead of the pack with better business banking.

LOOKING FOR THE BEST SMALL BUSINESS CHECKING? YOUR SEARCH IS OVER!

When only the best will do, look no further than Do More BusinessTM Checking – one account that simply does it all.

Make the switch today

When you are ready to make the change, we’re ready to help with these quick and easy, step-by-step instructions.

Complete your application

in just minutes

It’s quick, it’s easy and it’s all online so you can focus on what matters most — growing your business.

Additional features and benefits

Convenient tools to make everyday banking easier

Take advantage of free online and mobile banking, remote and scanned deposit options plus electronic statements. It’s simply amazing.

Get reimbursed up to $10-per month in ATM fees

Need to make an ATM transaction on the road? We cover other banks’ ATM fees.

Integration with our business savings accounts

Looking to earn even more? Check out our high-yield online savings account options. Learn More

Additional Resources for Business Owners

Want tips and tricks to help keep you effective and efficient? Check out these articles specifically created for businesses and their owners. Looking for even more?

Rates last updated 9/18/2025. Rates are subject to change on any day and will be updated by 10:00 AM EST. Please be sure to check this page after 10:00 AM EST for the rate that will be honored today. Fees may reduce earnings on account, you must maintain an average daily balance of $10,000 to earn interest for a Do More Business Checking Account. The Daily Balance method is used to calculate interest. For additional information, visit our Disclosures page.

Dollar amount restrictions may apply.