As the fintech era brings significant change to the financial industry, it seems that even corporate insiders are constantly being exposed to new ideas and terms – and just as often left on their own to make sense of them. For example, many businesses are just now coming to fully understand and utilize “Banking as a Service” (BaaS).

Simply put, BaaS is critical to the distribution of banking products and services by third parties. BaaS products enable new, customized offers from brands we know. At the same time, it helps move new products to market faster by partnering non-financial companies (NFCs – also known as non-banking companies) with the infrastructure of regulated financial institutions. The following is a brief guide that explains more fully what BaaS is, how it functions and ways that it compares – and contrasts – with other fintech models:

What Is Banking as a Service?

What it is: Services from licensed banks that enable other businesses such as fintechs, non-fintechs and developers to access various financial products without having to construct them from scratch, integrating digital banking and payment functions directly into their own products.

Currently, BaaS providers fit into one of four configurations:

- Providers make their banking license, products, operations and/or technology available for use by aggregators, other banks and NFCs.

- Provider-Aggregators function approximately in the same way, but also couple their own capabilities with other vendors to develop a more complete single-source solution. First Internet Bank falls into this category.

- Distributors leverage customer relationships to offer unique turn-key financial services developed by third parties.

- Distributor-Aggregators enhance what they distribute to end users by adding new products or technology from multiple providers.

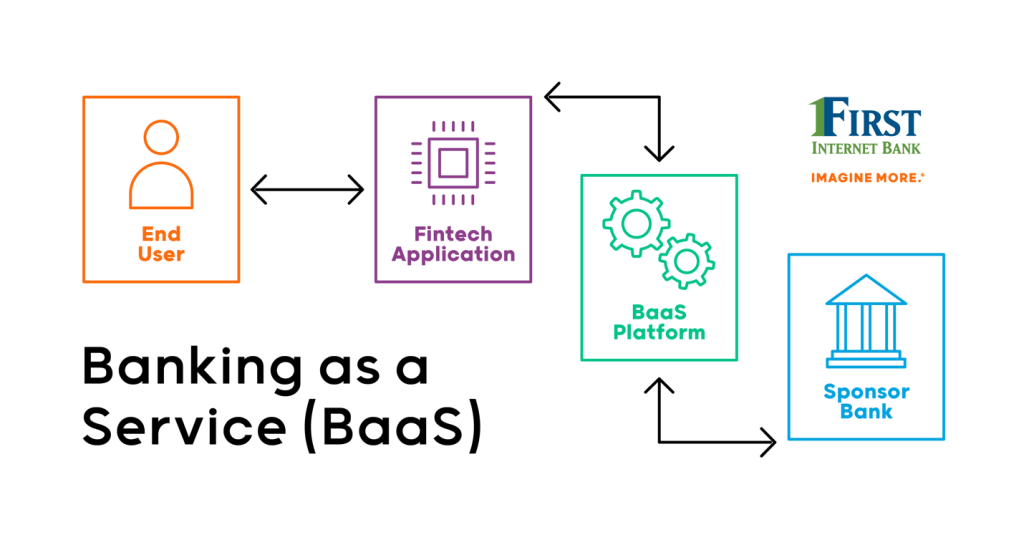

How it works: The front end of a non-bank business is joined to the BaaS provider via an application programming interface (API), which is a connection between computers or computer programs. It is a type of software interface that offers a service to other software, allowing businesses to provide their customers benefits through their own apps and websites.

Using API components, companies may choose the infrastructure they want and personalize it to offer a more customized experience for their customers. By selecting the best partner bank for services like payments, “know your customer” (KYC) guidelines for suitability and risk, operational oversight, BSA support, industry-compliant products and management, treasury management and more, businesses can create specialized, sophisticated financial offerings. Most importantly, this can be accomplished without investing in infrastructure or managing regulatory compliance simply by partnering with banks or financial institutions that already require this oversight.

Here’s an example: If a business wanted to build customer loyalty and increase brand interaction, they could offer customers a branded credit/debit card with a program that awarded points for usage. This not only builds the brand, but creates an opportunity to analyze customer spending behavior so they can provide even more targeted, individualized offerings. By partnering with a financial institution, NFCs can offer virtually any traditional bank product under their brand – including loans.

APIs aren’t new; for some time, financial software providers have offered bank clients APIs to fulfil their particular business requirements. With the introduction of open-source software – source code that anyone can inspect, modify, and enhance – vendors are now giving accessibility to a significantly larger customer base. In this scenario, buyers use the software in a plug-and-play arrangement, only paying for specific usage; this is otherwise known as “Software as a Service” (SaaS).

The beauty of SaaS is that it allows customization of product offerings to meet marketplace demands. However with the opportunity to provide a greatly expanded suite of banking products, BaaS has become a more attractive proposition.

But, there is a catch – the one we’ve already mentioned: to offer banking services, the Federal government requires some form of banking license. And, because of the importance of secure financial institutions to the nation’s economy, licenses are nearly impossible for non-banks to obtain. The government imposes significant capital requirements, compliance with strict regulations on money laundering, banking secrecy and deposit protection…along with a great deal more. Hence, the purpose behind Banking as a Service.

BaaS integrates the digital banking services from licensed, FDIC-insured institutions like First Internet Bank into the products of non-bank businesses in is what is commonly known as embedded banking. This way, a non-bank can offer its customers online and mobile accounts, debit cards, loans and real-time payment services without having banking accreditation.

The bank’s system communicates via APIs and webhooks (a less-encompassing API that powers one-way data sharing), enabling customers to access banking services directly through the business’ website or app. The non-bank entity doesn’t touch the customer’s money; it acts as an intermediary, which frees it from the regulatory duties a bank has to fulfil.

BaaS can allow virtually any business to become a banking product provider with just a few lines of code. This is often referred to as white-label banking, since the financial services are delivered to customers through the branded product of the non-bank.

In a clear sign that the financial industry will continue to evolve, it is estimated that the global BaaS market, which includes banks, wealth management firms, insurance providers and startups that offer supporting technology but no underlying financial services solutions, is anticipated to reach a valuation of $69.95 billion by the end of 20301.

First Internet Bank’s entrepreneurial spirit and digital DNA – dating back to our founding in 1999 – has helped us develop innovative approaches to effectively support emerging fintechs. We provide scalable, developer-friendly solutions that get products in front of customers faster. And, as demand grows, the same system supports a wide range of financial services that embed directly into your existing software.

Your big idea needs a launching pad – and that’s where we excel. We’re here to help you imagine more.