Open banking:

- What it is: non-banks can access data from their customers’ bank accounts to trigger payments from within an app or website, or to provide aggregated account insights.

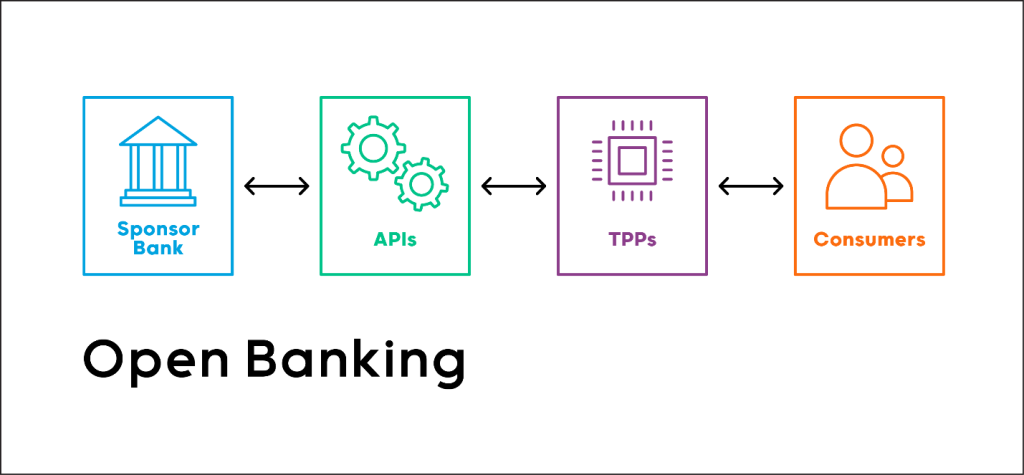

- How it works: Open banking providers connect to the bank’s system via an application programming interface (API) platform, which is a connection between computers or computer programs. It is a type of software interface that allows businesses, in this example, to retrieve data.

Banking as a Service (BaaS) and open banking are often confused because the latter also involves banks connecting to non-banks via API. However, the two serve entirely different purposes.

In BaaS models, non-bank businesses can integrate complete banking services into their own products. This allows them to offer virtually any traditional bank product, like credit and debit cards under their brand – or even loans – without building and maintaining their own banking infrastructure. Instead, they partner with financial institutions that can provide the necessary infrastructure and regulatory compliance.

Open banking originated in Europe in 2018. Since then, it has spread to over 50 countries, with open APIs becoming the standard for collaboration. In open banking, non-bank firms simply use the bank’s data (with explicit customer consent) for their services.

Across the industry, these organizations are called third party providers (TPPs), and can be service providers like insurers or financial management applications that use open banking to access and aggregate client account information from different banks without having to log into each bank’s website or app separately. This not only saves time, but also provides a clearer overview of customer finances. Fintechs also can be TPPs, expanding their capabilities to provide a multitude of financially-oriented services to their customers.

API integration can also be provided by a third, unrelated, group. These are categorized as API banking platform providers, and are “middle men” that connect the banks with TPPs like the financial management app. They supply the actual API layer sitting on top of the bank’s system that enables the flow of data between the bank and the TPPs.

The key aspect to remember through all this, though, is that TPPs are not able to perform actual banking services (such as lending or taking deposits), because, like other non-bank users, they do not have banking licenses. They are simply repurposing account information from existing bank accounts to provide overviews or perform transactions.

The average consumer, whether a personal or business banking customer, has a combination of credit cards, debit cards, checking and savings accounts, insurance products, retirement accounts and more, that most likely involve a number of different financial institutions and fintechs.

Thanks to open banking, consumers and business owners now have the ability to access and respond to banking data, such as being able to view a single 360-degree overview of all their accounts and even make direct, single site, payments from these varying accounts. Bank accounts can now link to loyalty programs, share data with accountants and advisors, and even more.

Increasingly, fintech companies are adopting open APIs to create and offer digital products that help users better understand their finances. Now, both individuals and companies can perform detailed analysis of their finances and maintain greater control of their money – and there’s even more on the horizon!